The Federcalzature convention revealed the current marginality of e-commerce compared to traditional retail but also the incredible growth rate of the phenomenon

Massimo Donda, opening the Federcalzature convention on e-commerce held during Micam, pointed out the fundamental questions many are now asking:

Considering one of the worst predictions in history – that of Ken Olsen, founder of DEC Digital Equipment Corporation, who said: «There is no reason for anyone to have a computer at home» – how do we look at the e-commerce phenomenon? Will it wipe out normal retailers? Will future shops be only virtual?

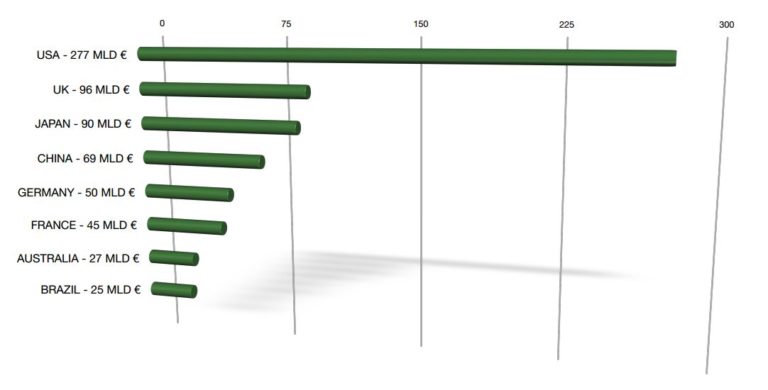

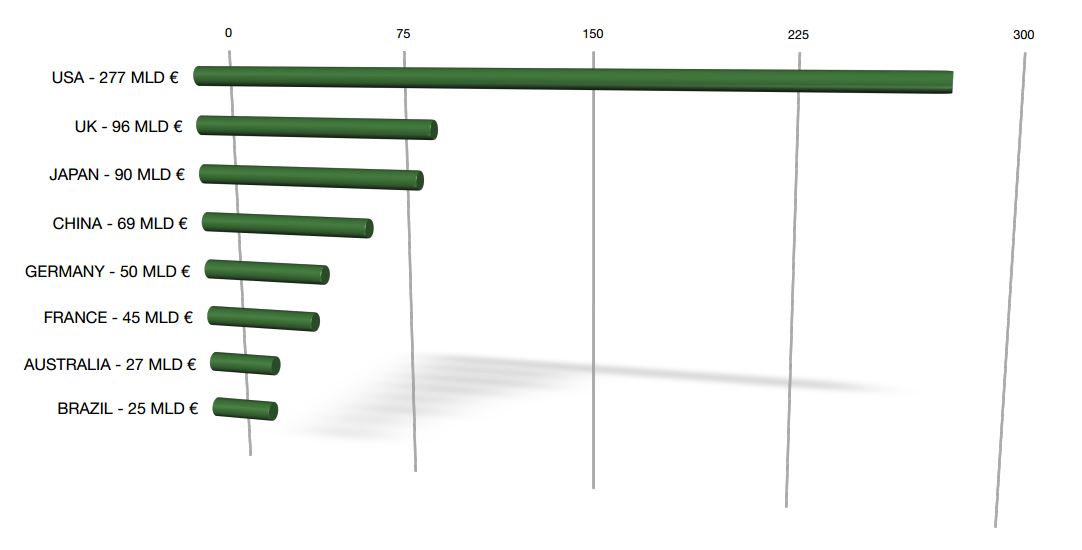

Roberto Liscia attempted to reply. What impresses one about the data presented by the chairman of Netcomm is not so much the slice that e-commerce has regarding total distribution, frankly laughable seeing the 2% for Italy and 3% for Europe. It is the growth rate of this type of business that makes an impression: in 2012 European online sales arrived at 314 billion euro, chalking up a +20% (in Italy as much as +55%).

DOWNLOAD REPORT

Taking a wider view, despite the fact that this phenomenon still hasn’t seen the boom predicted by many analysts, international e-commerce in any case arrived at a turnover of 889 billion dollars in 2012 and around one billion people have bought at least one article online. Getting back to Italy, as regards the type of best-selling goods, clothing is top of the list with an increase of +39% in the last 4 years. Among fashion goods clothes are the first choice (43.7% have bought at least 1 garment), followed by footwear (34%), accessories (31.6%) and women’s bags (18.1%). For a more detailed breakdown of the footwear chosen by those who prefer to buy online, these include trainers (14.7%), men’s shoes (3.5%), kid’s footwear (3,1%) and loafers (2.1%). Therefore this is a business outlet, still small but with excellent growth prospects (always taking into account numbers on the real profits that giants in the sector such as Sarenza and Vente Privee do not issue, creating doubts that the margins are not so interesting and there are still outstanding difficulties like the right of withdrawal).